[NAB] NAB Flagship Event: NAB FORWARD VIEW

- September 6, 2023

![[NAB] NAB Flagship Event: NAB FORWARD VIEW](https://agents.oxbridge.com.au/wp-content/uploads/2022/06/NAB-Logo-300x169.png)

Dear Oxbridge Partners and Affiliates,

Mortgage Brokering is a phenomenal industry that offers truly passive income and the ability to build your book. The average income of mortgage brokers earns is $188,046 (https://www.brokernews.com.au/news/breaking-news/how-much-do-australian-mortgage-brokers-earn-280893.aspx) whilst top brokers can earn over $2m a year often in passive income (https://au.finance.yahoo.com/news/cba-apos-top-200-mortgage-191804595.html). The best thing about finance brokering is the TRUE PASSIVE INCOME. Oxbridge Training (www.oxbridge.training) offers individuals to obtain their certificate and diploma in mortgage brokering in a short amount of time. Very few professionals are qualified in both real estate and mortgage brokering. The key to a successful mortgage broking business are the leads. With over 4,100+ online listings and another 1,000 off market listings the Oxbridge Real Estate business provides an excellent source of lead generation.

Time and Date: Thursday 23rd November, 2023 1-3pm AEST (QLD: 12.30pm, WA: 10.30am, SA/NT: 12pm)

See: https://nabbroker.tv/

RSVP: support@oxbridge.com.au

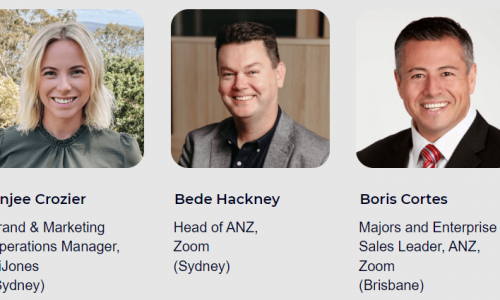

Oxbridge members have been invited by NAB to their flagship event. The finance and home lending industry continues to be transformed by digital innovations, artificial intelligence and evolving customer needs, which present new opportunities and challenges for mortgage brokers and business owners. This November, we’re pleased to welcome you to NAB Broker’s flagship event: Forward View. We’ll be joined by our special guest from Google, Sean McDonell, for an in-depth interview with NAB Chief Marketing Officer Suzana Ristevski, examining the emerging trends in consumer behaviour and the digital marketing approaches you can adopt to future-ready your business for growth. Hosted by leading TV presenter and journalist Rebecca Maddern, this broker-focused event will also deep dive into the technological advances being made in the fraud and scams arena, with information about how NAB is tackling cybercrime and how our Security Advisory and Awareness team can support you in protecting your business and customer data. We’ll also hear from senior NAB executives including NAB Chief Executive Officer Ross McEwan; NAB Group Executive Business and Private Banking, Andrew Irvine; NAB Group Executive, Personal Banking, Rachel Slade; NAB Group Chief Economist Alan Oster, NAB Executive, Broker Distribution Adam Brown – and many more! With 70% of customers choosing to work with brokers, this event will explore how NAB, as the Bank Behind the Broker, is making it easier for you to do business with us and support your customers in this dynamic environment. Along with the insights gained from this event you will also receive CPD points for tuning in.

ABOUT THE MORTGAGE BROKERING BUSINESS

Although the details around when and how brokers receive commission varies from lender to lender, generally speaking: Upfront commission: 0.65% (+GST) to 0.85% (+GST)

The upfront commission is the largest component of the commission. The broker receives this once your loan settles. Trail commission is what the broker receives every month for the life of the loan. Usually, this trail is set at 0.15%-0.40% per annum based on the remaining loan amount each year. To be clear, mortgage brokers don’t work for the banks, although there are some mortgage brokerages that are partly-owned by banks and larger lenders. Oxbridge is always 100% independent (e.g. Aussie is owned by Lendi which is owned by numerous shareholders including CBA, 1835i (ANZ’s external venture capital partner) and Macquarie Bank, RAMS is owned by Westpac, REA owns Mortgage Choice etc)

Working on a typical loan size of $750,000 and writing 20 loans in the first year. The commission received by the broker would be

$750,000 (20 x 0.70% + 20* 0.45%) = $105,000 (upfront) + $67,500 (Trail) = $172,500.

Top brokers in Australia (See https://www.mpamag.com/au/best-in-mortgage/top-100-brokers-2022/429801) receive well in excess each year of $3M upfront commission and at least 3x that in terms of trail commissions for the life of the loan. Several Oxbridge brokers are doing exceptionally well earning 6 figure income. Some Oxbridge members are dual qualified in mortgage brokering and real estate which is a huge competitive advantage in the market place. Trail commission is really true passive income

The Oxbridge Finance Team